Company Issues Convertible Bond

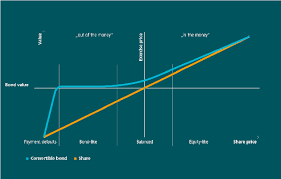

In financial investing, a convertible bond or convertible notes or convertible bond note is a kind of bond which the holder is able to convert into cash or a specified amount of stock in the underlying company. It's a hybrid financial product with equity-like characteristics and debt-like aspects. It offers greater flexibility than conventional debt instruments. A convertible bond document contains the indenture, certificate of interest, fee agreement, and additional indentures. Convertible bonds are usually classified as debt security. That is, they are purchased to meet the needs of financing an investment in which the purpose is the realization of a gain. There are many kinds of convertible bond products. Two of them are common-rod interest-bearing and common-rod coupon-paying. A common-rod bond is usually purchased by private investors. For this reason, the fees for the transactions may differ and the maturity date may be immediately closed by the issuer. The convertible bon...