Company Issues Convertible Bond

In financial investing, a convertible bond or convertible notes or convertible bond note is a kind of bond which the holder is able to convert into cash or a specified amount of stock in the underlying company. It's a hybrid financial product with equity-like characteristics and debt-like aspects. It offers greater flexibility than conventional debt instruments. A convertible bond document contains the indenture, certificate of interest, fee agreement, and additional indentures.

Convertible bonds are usually classified as debt security. That is, they are purchased to meet the needs of financing an investment in which the purpose is the realization of a gain. There are many kinds of convertible bond products. Two of them are common-rod interest-bearing and common-rod coupon-paying. A common-rod bond is usually purchased by private investors. For this reason, the fees for the transactions may differ and the maturity date may be immediately closed by the issuer.

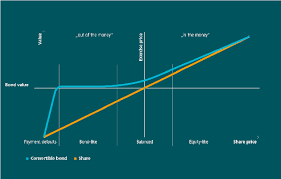

The convertible bond document has a fundamental illustration of the process of conversion. It shows the conversion ratio of the common-rod interest bearing portfolio and the conversion ratio of the coupon-paying portfolio. The two ratios can be easily determined by the investor by consulting a separate sheet provided by the bond issuer. This type of calculation is useful because it helps investors decide whether to buy or sell during specific times of the year.

The term "conversion" refers to the legal action of changing one class of debt to another. Bonds that mature are considered convertible. This is why such bonds are also known as "fixed income." On the other hand, when the period of the maturity is not reached before the conversion occurs, the investor is still required to hold the original principal amount of the bonds, plus the accrued interest.

There are various ways in which investors can determine the conversion value of a convertible bond. One of these is through the use of the present value of the net asset value of the underlying stock or equity. The convertible bond document explains that the present value is the difference between the current market price of the underlying stock or equity and the current conversion value. Another method of computation is through the discounted value of the original par value. This means that, at the maturity date, the discount rate equals the present value of the amount of the premium paid, less the current discount rate.

Another way to determine the conversion feature of a convertible bond is through the formula of dividends to capital. This is implemented by simply dividing the total bond value by the outstanding balance of the issuing company. Usually, this formula yields the exact value of the dividend. The convertible bondholder will be able to determine the amount of his dividends.

There are two different types of convertible bond issues that conform to the indenture agreement. One type features a fixed number of coupons. Another type features a variable coupon rate.

A convertible bond normally sells for less than the face value of the stock. A conversion ratio is used to determine the intrinsic value of a bond. The intrinsic value is determined by subtracting the premium from the current market price of the stock. The lower the figure is, the more underpriced the bond is.

Another method of determining the valuation of a convertible bond involves the use of the term appreciation potential. This term is used to describe the extent to which the underlying stock's price may change between the time of issue and the date of conversion. A discount rate that is set at the time of issue is referred to as the discount rate. The other term used is the term premium. Premium refers to the amount paid by the issuer to the bondholder.

A bond is considered underwriter's liability when there is a difference between the issuing company's and the bondholder's equity or ownership interest in the company. Underwriters make their estimates by valuing the company's stock and selling certain bonds. Bond prices are affected by a variety of factors, such as the performance of the corporation, debt, credit ratings, and market volatility. A corporate bonds' conversion ratio provides information on the liquidity of the underlying stock shares.

Some companies issue convertible bond for the purpose of raising capital. These companies may issue convertible bonds in order to secure new loan amounts or to repay existing debts with new stock issued by the issuer of the bonds. Convertible bonds also provide flexibility to the issuer. Since convertible bond do not come under the fixed definition of securities in the United States, a company may issue these bonds for the purpose of raising money or for the purpose of creating a new business.

Comments

Post a Comment